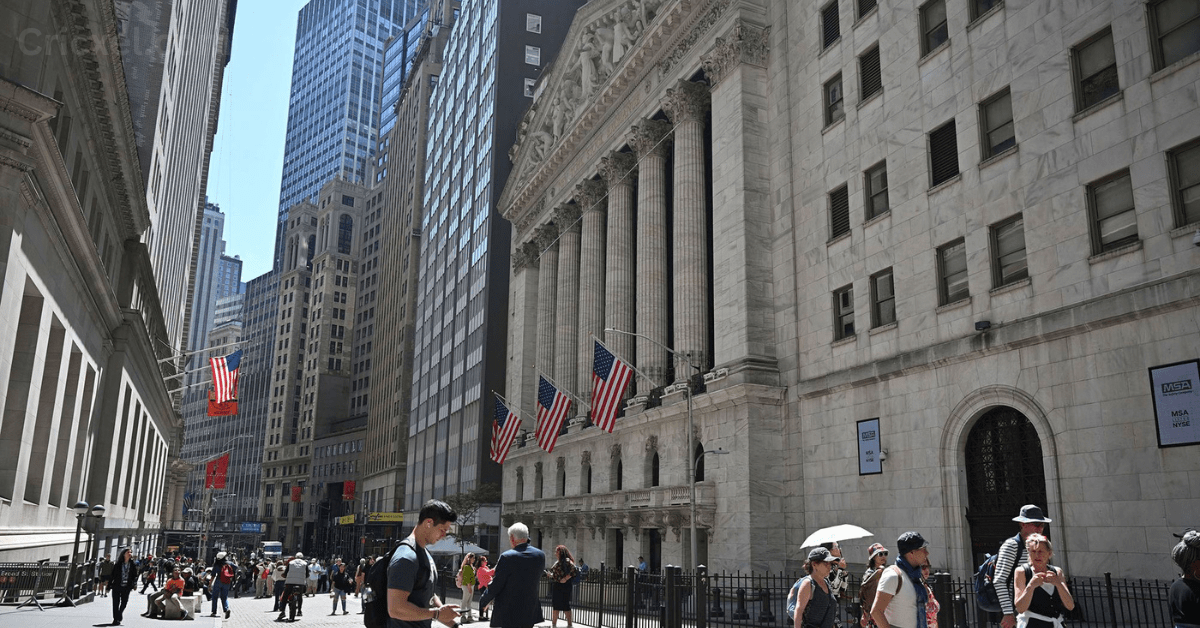

A technical issue that forced trading for many large equities to halt and resulted in a 99.97% decline in Berkshire Hathaway’s stock price been fixed, the New York Stock Exchange announced on Monday. The NYSE provided an update, stating that all systems are currently operational and that affected stocks had reopened.

An official at a big bank who spoke with ICE told CNN that Intercontinental Exchange, the parent business of the New York Stock Exchange, had not discovered any evidence that the malfunction was the result of a hack.

Rather, a NYSE representative stated that up to 40 symbols listed on NYSE Group exchanges experienced trading halts due to a “technical issue” with industry-wide pricing bands.

The Security Information Processor (SIP) of the Consolidated Tape Association (CTA) is responsible for publishing such price bands, according to the NYSE. Real-time trading and quotation data is published by the industry association CTA.

CTA said that one of its problems “may have been related to a new software release.” The industry association said that in order to resolve the problem, it depended on a backup data center running an outdated version of the program.

According to the NYSE website, dozens of equities were halted earlier in the day, indicating that they moved outside of those so-called limit up-limit down zones. Chipotle and Berkshire Hathaway, the holding firm led by renowned investor Warren Buffett, are on that list.

Berkshire Hathaway’s Class A shares were trading at just $185.10 for almost two hours, which would be a 99.97% loss. On Friday, Berkshire ended at $627,400.

The New York Stock Exchange (NYSE) said that it has chosen to “bust,” or reverse, any “erroneous” trades for Berkshire at or below $603,718.30 between 9:50 and 9:51 in the morning. The exchange threatened to invalidate more deals and stated that the decision is not appealable.

An SEC representative told CNN, We are keeping an eye on the situation and interacting with market participants.

Themis Trading co-founder Joe Saluzzi told CNN that it is difficult to reconcile the NYSE’s explanation with the strange deals that were captured on camera. I don’t accept that justification. Saluzzi, a market structure specialist and the author of “Broken Markets,” stated, “That doesn’t make any sense to me.

As of 9:44:32 on Monday morning, Berkshire Hathaway traded at $620,700, according to trading data supplied by Refinitiv. Then, for no apparent reason, the stock fell to only $185.10.

Suddenly, a $185 print appeared. However, as one might anticipate, there was nothing to undermine it one level at a time, according to Saluzzi. “It doesn’t make sense. The general stock market went primarily lower due to fears about economic development, but the technological problems did not seem to have an effect on it.

With the exception of Berkshire, the majority of the stopped stocks and exchange-traded funds (ETFs) were just marginally moving in either direction.

More—

Trump’s Criminal Conviction Found Guilty on All Counts Creates History

Refinitiv reports that Barrick Gold (GOLD), a Canadian producer of copper and gold, was trading at barely 25 cents, down 98.5% on the day. Barrick had returned to normal by lunchtime, trading at $17.28, up 1.1% for the day.

The producer of modular nuclear reactor technology, NuScale Power (SMR), which went public, was trading for barely 13 cents on the market, down 98.5% for the day. NuScale was down about 5%, trading at $8.29 when it resumed.